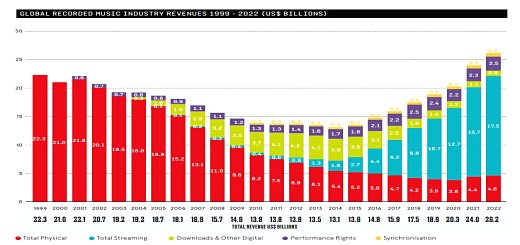

Is the music industry being reshaped for the better or worse by tech companies?

A great show by CBC News about the future of music and the effect technology has on it. CBC News Explore’s BIG MUSIC looks at how Spotify, Ticketmaster, LiveNation, and Tik Tok are changing the very nature of music. It goes way back to the very beginning of recorded music and ownership of music, to the current moment of non-ownership. Great stuff!